Escrow ID Verify Documentation

What is Escrow ID Verify?

Escrow.com's Know Your Customer (KYC) program ensures the safety of all transactions by confirming customer identity through documentation collection. This helps prevent fraud, money laundering and the financing of terrorism.

Escrow ID Verify is the ideal solution for any partner who requires to verify the identity of their customers whilst handling transactions on Escrow.

- A transaction must first be set up between a buyer and seller.

- The transaction create response indicates whether a customer in the transaction requires additional verification.

- The partner makes a request to verify the identity of a given customer.

- The verify response provides a unique URL the partner would send the customer to.

- Customers provide their details and submit the required ID verification documents and are then returned back to a URL provided by the partner.

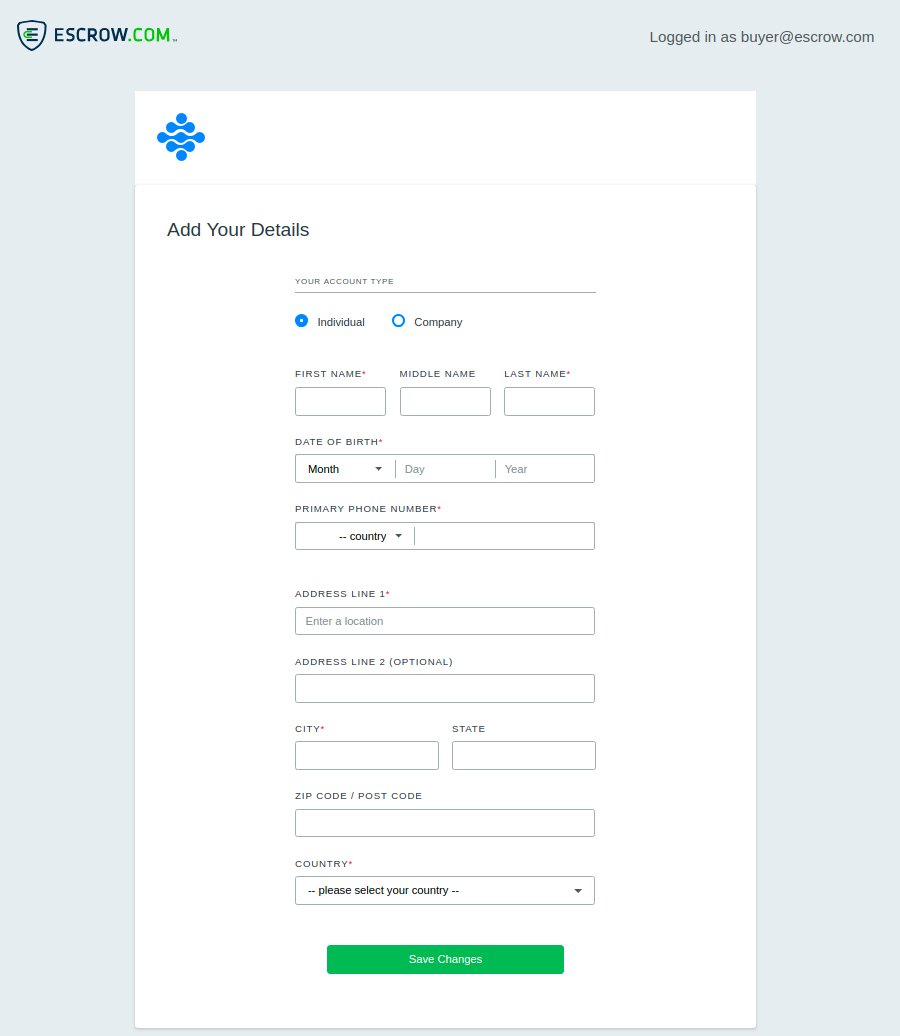

Here is a screenshot of the adding details step:

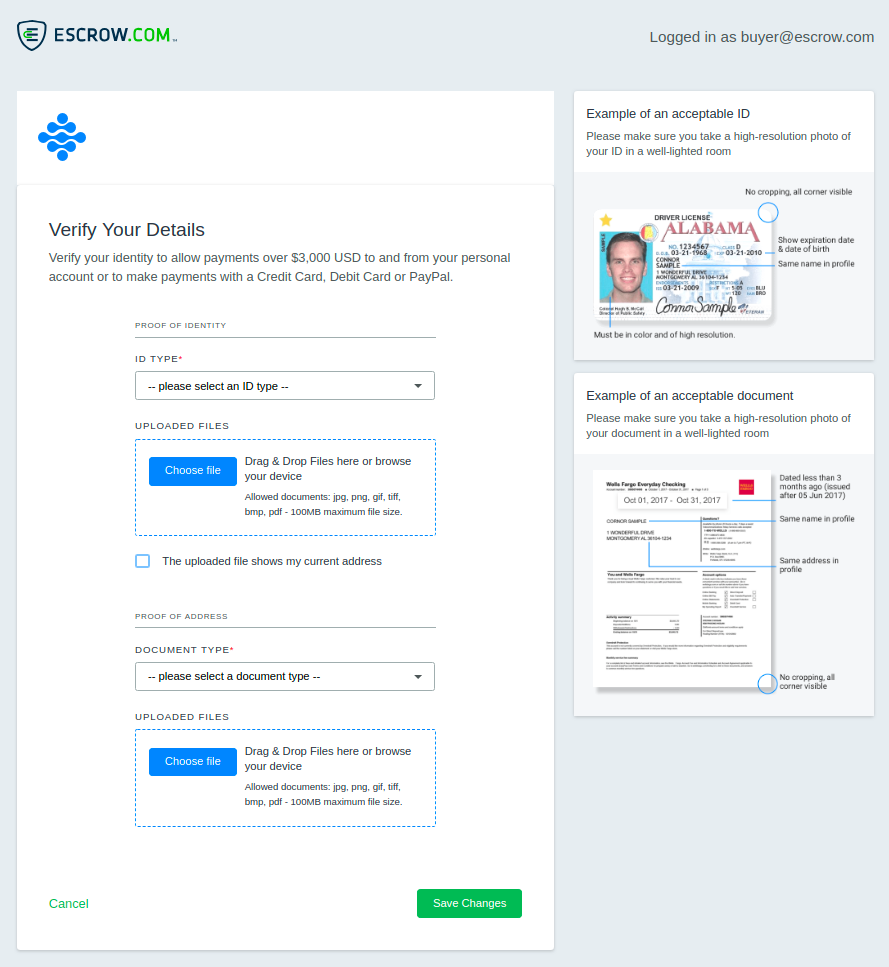

Here is a screenshot of the uploading verification documents step:

Calling the Escrow ID Verify API

To request a verification of a customer, a transaction must first be created between the buyer and seller. Please refer to the transaction create documentation for more details on how to perform this step. Ater making the transaction create request, the response body will contain details about the newly created transaction. Within the response, there is a parties field which is an array of party objects that are involved in the transaction.

Example Transaction Create Response

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27{ "creation_date": "2023-09-30T00:00:00.000000+00:00", "currency": "usd", "description": "My Escrow Transaction", "id": 123456789, "items": [ ... ], "parties": [ { "agreed": false, "customer": "buyer@escrow.com", "id": 123, "initiator": false, "next_step": "...", "role": "buyer", "verification_required": true }, { "agreed": false, "customer": "seller@escrow.com", "disbursement_method_selected": false, "id": 321, "initiator": false, "next_step": "...", "role": "seller" } ] }

If a party requires additional verification, theverification_required field will appear within the party object. To request the verification of a party, you must provide the transaction id, the party id that you wish to verify, as well as a return URL which you wish the customer to return to after they complete the verification proccess. Using this information you may request the verification by performing a POST request as seen below:

- cURL

- Python

- Ruby

- PHP

- C#

1 2 3 4 5 6 7 8 9curl "https://api.escrow-sandbox.com/integration/2019-03-01/transaction/123456789/verify" \ -X POST \ -u "email-address:your-api-key" \ -H "Content-Type: application/json" \ -d ' { "party_id": 123, "return_url": "http://www.return-url.com/landing" }'

Example Response

1 2 3 4{ "landing_page": "https://www.escrow-sandbox.com/verify-landing?token=dd42db00-b769-4c62-a2c7-8dba71eb2405", "token": "dd42db00-b769-4c62-a2c7-8dba71eb2405" }

landing_page attribute

The landing_page attribute contains the link to which the customer should be redirected to after they complete the verification proccess.

token attribute

The token attribute contains the token which is used to identify the customer verification request. While it is embedded in the landing_page, it is split out here for convenience.

For help on making API calls and configuring transactions, please review the links below.

Company Logo on Verification Page

Partners are able to add their company logo alongside the verification page that is presented to customers. This can be achieved by uploading a company logo here.